The lumber market is easy to beat when you know what's coming!

This is your

LUMBER MARKET’s CRYSTAL BALL!

START THE FREE TRIAL TODAY

When I say “lumber market” I mean the kind of lumber we build a house with that quadrupled its price in 12 months in 2020-21.

Then in one month, June 2021, lost half its value.

Suddenly lumber is popular at the gym, in church, even at the hair salon.

We are not here to chit chat with the barber.

We are here to revolutionize how to look at, and behave towards, your lumber inventory strategies.

Therein lies the secret to Forecasting the Lumber Market…

Repeating - Predictable Human Behavior.

To the gym member, church goer, salon visitor, and even the unaware lumber participant, this commodity appears to be wildly volatile.

Volatile yes....but cyclically predictable as well...and we can benefit from that by observing and and anticipating how lumber folk will act and react under different stresses and repeating Preparations for Demand.

Today however, Instead of rehashing old headlines and conspiracy theories, how would you like to take a peek at Lumber’s Crystal Ball.

YES! There is an actual, working, real lumber market crystal ball.

My crystal ball reveals “when” the price of lumber will reverse and accelerate, with 86% accuracy

(+/- one week margin of error)

It is referred to in Layman’s Lumber Guide terms as

Forecasted Decision Points (FDP’s).

*As a professional trader, buyer and market analyst I can say with 100% confidence, these FDP’s are all you need to Beat the Lumber Market. Remember, we are dealing with time not price. If we get the timing right, all that’s left to do is come to work each day and see how much money you make from your business just doing what it does. Sell and deliver lumber.

Now let’s take a look at that Lumber Crystal Ball.

Layman’s Lumber Guide

Forecasted Decision Points...FDP’s

The lumber market’s crystal ball.

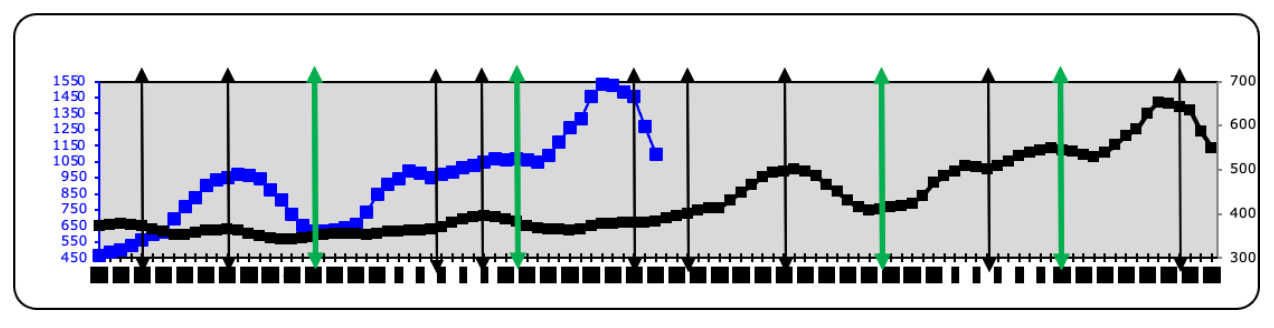

The black & green vertical lines are FDP’s, weeks where Layman’s Lumber Guide projected a lumber market directional change...12-months behind and 12 months ahead. (Prepared June 20, 2021).

Not too shabby, eh? For those viewing this in the future, this is the end of week #25, 2021. The FDP’s project continued downward movement into week #28. From there we are looking for a post-COVID pandemic summer rally.

It gets even better.

I would like to show you exactly how to use the FDP’s in your lumber business to become a better buyer, seller and planner with a 1-month free trial.

You can ride shotgun for one month and see first hand how to beat the lumber market and make some money while you learn.

Who markets like that? Pay you to play? That’s absurd! So is what you are about to learn.

Ready To Beat The Lumber Markets?

Let’s get started right now.

No charge card needed. No Gimmicks. No "Cancel any time". No payment info at all.

Simply tell us your name and where to send it, and you'll have the crystal ball delivered to your inbox for 4 weeks.

Why is there no option to buy on this website?

After nearly 40 years of predicting trends in the lumber market, with a success rate of 86% we believe in putting our money where our mouth is.

In order to get the most of this trial:

- During month 1, you will become familiarized with the data and analysis and the actions that you take will more than pay for the full year's subscription cost

So, in summary, you can't buy it until it's already paid for itself.

"Earn while you Learn"

What People Are Saying About Our Forecasts

Hundreds of lumber producers, wholesalers, lumber dealers, wood preservers, component manufacturers, and builders read these forecasts each week. Here's what they have to say:

"Why are we a member of LLG? The quick and easy answer is that most of the time you get it right. Oh, sure, there is the occasional miss, and sometimes not even a close miss, but in all the years we’ve been subscribing (maybe 20+?) the majority of the time you get it right. There are other publications to be had but the LLG, even back when it was the Pine Page, got us the closest to the market dips and spikes than most. You have evolved and adapted to the market but the basis for your information has remained the same, the market runs in cycles and history does repeat itself. If you have a favorite sports team you know they are going to have the occasional stinker game, it’s inevitable. But usually after that stinker is when they are more focused and determined than ever. The same can be said about you. You usually rebound more focused and determined to get it right after the once-in-a-while stinker miss. Bottom line, 86% of getting it right, to us, is worth the price of admission. Now, if we could just get the Falcons to win 86% of their games."

- H. Tery Overbey, Hill's Ace Hardware & Lumber Center

"Why Layman’s Guide? Information, and I can't have enough of it. On my end I am able to talk with my suppliers and warn them that they need to make or hold off on buys that will benefit them and myself along with holding them accountable for the prices I get from them. As far as missing something, it happens. But you're quick to react and have spot on information on why you missed it but you're still ahead of the masses so the right corrective actions can be taken. Since I'm the end user and know what I have in my pipeline the info you are giving to the supply side helps me project the risk we have to overcome. One example of this is very small but a very important one, you have been warning for over a month now about treated lumber issues and it has become a real issue today but I talked to my supplier about bringing in some 2x4x16 treated plate about 5 weeks ago and letting me buy three units of it from him so he did not have to carry any inventory cost, why you may ask it would be awful hard to start a home without any treated plate material. We would be shut down."

- John Breckenridge, Hallmark Homes

"In my seat as a commodities purchaser, the most critical and profitable portion of my job is forecasting. Robots can fill empty slots but planning and making educated guesses (i.e., forecasting) is an art combining many, many factors and nuances which few outside of the purchasing realm fully grasp. You, my friend, are the only source I have found in the market who has the cojones (you may quote that as “guts”) to actually walk the walk and dare to live in the subjective world of interpreting data with a 100% percent chance of being wrong from time to time. There are the occasional industry writers who dare to pen forecasts for “the future” - far enough out and obscure enough to be forgotten or of little impact - but you dare to live in the here and now, in the trenches where I and my peers have to make decisions every day that are going to financially impact our company’s and coworker’s financial return in the very short term future. Reports such as Random Lengths and Shoe’s have their place as historical data but they leave all of the extrapolation of the potential impact of that data moving forward squarely in their reader’s lap. On the other hand, you look at historical market data, human behavior, repeating patterns in the supply/demand counterbalance and market drivers (mill output, reported purchase volumes, car and truck volume, futures and current social-economic factors) and come up with a forecast. The info alone is worth the value but when combined with your FTP tool, it all combines as a great tool to mirror against my own preconceptions, market knowledge, historical data and current market activity to come up with the best decisions for my company. You claim an 80+ percentile in accuracy which is something I can confirm from my own historical experience. I’ll take those odds any day in this crazy world we call commodity trading. As an independent thinker I don’t always agree with your calls but your tools are proven winners and your thoughts are well established as level headed, astute evaluations of what we face in our daily challenges as purchasers. In this business, only one or two good tips will more than pay for the subscription costs which leaves your continuing stream of insight as an excellent return on investment."

- David Wells, Goldsboro Builders Supply

"Matt, Any help to follow market trends helps me tremendously. I have been in the business for many years, but on the sales side only. Sitting in the captain's chair is a different look all the way around. Even the stories, words of encouragement, past and present details that have been “trends'' are a great help to me. I have personally started using some of the words that I feel have a powerful meaning in some of our meetings. I have heard stories of the past owner Scott Wright, and the ups and downs, but never really felt them. When covid-19 hit, after about the second week, I watched my wife cry across the hall one day because we thought (this is it). Everything we have worked for all our life is about to come to an end. We are in our late 30’s early 40’s with preteen children. We were trying to figure out what we were going to sell off first. But I felt deep down from one of your articles that we were close to the “turn” in the market. She's begging me to quit ordering material…. I told her to just wait and give this another week, at the time I was still ordering trucks of material because the market was moving fast. And then, it hit. We went from a straight drop to bottom, to a straight up to top. But we were going to have a bridge to cross between the two because of how it happened so rapidly. That was my next hurdle to cross. We crossed that bridge June 1st and we sat that day at 38.5% up from last year's numbers. Actually numbers were up for the first half of year from everything I could find for the last 20 years. Sorry to ramble but YOUR words were what I looked to for a guiding map during those times. I realize we are far from out of the woods, but with what we went through a few months ago, I do sit a little taller and proud but also very HUMBLE and willing to learn more. Thanks for all you do."

- Jason McDaniel, President, City Lumber Company of Dyer

Common Questions

Have a question not list below? Email me at [email protected].